Greensky facilitates home improvement loans to consumers interested in upgrading their home. They work with various banks that fund the loans which are marketed through home improvement contractors, merchants, and retailers.

The attraction to Greensky is consumers can receive a loan and take advantage of the deferred

interest loan which can be paid off during the promotional period. It’s a convenient loan for consumers

trying to upgrade their home who are offered the loan at the same time.

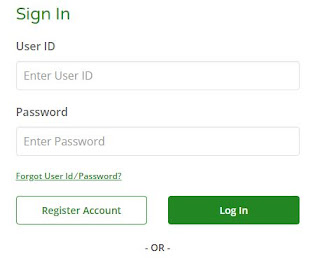

Borrowers can repay the loan online using https://websnips.net/www-greenskyonline-com/ at www.greenskyonline.com.

Highlights of the Greensky Credit Program

To be eligible for a loan candidates should have excellent credit. Your credit score should fall in the

range of 680 and 770. There is an option for co-signers which will only improve your option to get

qualified.

The maximum loan amount offered through the program is $65,000. Any amount needed under that

amount is allowed.

The loans offered through Greensky are deferred interest which is interest free for the duration of the

promotion period. You will need to pay off the loan during this period to avoid paying higher interest

rates.

The deferment interest rate periods fall between 6 and 24 months afterwards loans range between 5

and 12 years.

The funds that are approved under the program are only for home improvement. They cannot be

used for any other purposes. Other purchases outside of home improvement will be denied.

If qualified for a loan funds are granted the same day. You will be extended a credit line that you can

begin using immediately.

One point consumers need to understand is your loans are not provided through Greensky. Greensky

does not lend money they are only a facilitator between the consumer and the banks. They provide

the Greensky online portal to collect payments and give the consumer a better way to manage their

loan account.

https://t.co/Bf776AI5TO - Login to Payment Portal https://t.co/sVA0Tn0WvC— websnips (@websnips) January 13, 2019